Private institutions. Private institutions in the United States are integral to the overall higher education system. From the hallowed corridors of Harvard to the groundbreaking education made available to women at Wesleyan College, private colleges serve to educate and prepare students to become productive members of society. While public colleges and universities also serve a similar purpose, there are distinct benefits to attending a private institution.

The focus of most private colleges is the student rather than research and publishing, as is common at public institutions. This student focus allows private colleges to favor professor-led lectures and labs rather than a teacher's assistant-led class. Students benefit from a highly educated professor's new knowledge and expertise rather than a graduate student. Professor-driven classes also help reduce discrepancies between the information presented in a style and the information covered in exams. Private institutions keep small class sizes as a reminder that students come first. By having lower classes and individual attention, students can ask questions and reflect on their thoughts more easily. Categories of small size have more interactive classroom experiences.

Students are more known at large universities by their identification numbers than their names. Knowing your professors and other students at smaller private colleges is easier. There are more opportunities for recognition and awards for exceptional students than at public institutions. Religious denominations many private colleges have. Private schools can present students seeking a college with close ties to their religious faith as a place to study with others of their same faith. For some students, scholarships are available based on their ethical relationship.

Are you planning on playing college sports? The college you aspire to, the education you need, and the dreams that you have had are all part of your future. Apart from your academic curriculum at the institution are sports. To be noticed playing sports in college can be fun and gratifying. However, you are not likely to receive grants except if you are already making headlines. America is a multicultural nation; it is vital that everyone, no matter what race or ethnicity you belong to, has an equal right to a good education. Getting into college, especially a good one, requires some early planning. It would help if you understood what it takes to get into a top-notch school. You also need to know what is necessary to play for a Division I or II school since you need more than athletic skills.

Suppose you plan to play sports at I or II Division levels as a first-year student. It would be best to familiarize yourself with NCAA eligibility prerequisites as early as your sophomore year of high school because you need to meet them to make the team. Every athlete must meet minimum standardized test scores and core curriculum requirements, whereby you must continue to meet academic needs each year. Excelling at a sport will only keep you on a college team if you satisfy the NCAA's and the school's educational program conditions.

NCAA academic requirements vary depending on the division level of the school. Still, you can be sure that you will need to maintain a GPA of 2.00. The NCAA publishes an annual guide on the ins and outs of eligibility and distinctions among recruiting rules at I, II, and III Division schools. Look for the handbook at www.ncaa.org. Broadly established, an important goal in education is a post-secondary degree. The United States labor market strengthens that belief with substantial financial rewards. Due to a sizable percentage of minority students living in disadvantaged areas, the public education system is responsible for educating students about all instructive endeavors post-graduation. Make sure that your child receives college preparatory awareness and teaching. They are your kids, so get them to think of their children someday by being well-educated. We have excellent programs for many; it is up to you which is best for your needs.

© 2024 PSALTER 46 Investment Services™, LLC. All Rights Reserved.

The more prestigious the school on which your child sets their sights, the more it will cost, and the more you will have to keep or borrow to meet tuition and other fees. Many schools charge far less tuition than Ivy League Universities. They also provide high-quality education, though they may not have a meaningful status. Sending your child to one of these institutions may ease some of the financial pressure.

Though you cannot answer with much certainty the hypothetical questions posed above, you force yourself to confront the reality of how much to save. Most parents keep far less than they ultimately need for college costs. If you can motivate yourself to invest, you will be further ahead of most people. After all, your needs can be met for your child and with the school of their choice. If you require a higher ETR as quoted. Then your EPO would need to be augmented to match your institute’s requirements. We customize academic programs from your request to fit any institution. We are acquainted with taller EPOs by pairing them with the finest of schools worldwide.

We offer “The Prestigious University Elite Planner” for $899.99. This purchase comes with student’s Health Care Coverage for six years, Dental Health Care Plan for four years, Life Insurance for six years, and two (2) round trip airfare tickets home. One travel ticket during the summer break, and your child will also be put in the HGPAP for 24-months to help achieve getting into an elite school of their choice if funds do remain from the ETR. It will be rolled over into a retirement account of your choice. Click here to order.

Understanding average costs of a college education. As the price of a four-year degree continues to rise, it is vital to understand the value that a degree provides. Currently, nearly every highly regarded high-paying Company looks closer at job candidates with a degree than those without, even if the degree is unrelated to the sector or industry. Alternatively, a degree tells a story of stability, determination, focus, and dedication to job responsibilities to prospective employers.

The prospective employers, in thinking, hold this thought that if the potential employee can push through school despite the cost, they will most likely give all in the workplace. As you know, not everyone can afford the average price of earning a degree. That does not consistently mean that person is any less qualified than someone with a college education. On a positive note, someone interested in getting a degree has numerous alternatives that help. In addition to student loans, that would be the least desirable option since you need to pay back the debt for years to come. We are the other means of earning a degree without obligation to others. The average cost of earning a college degree starts with this Company at $21,641.79 in today's market. Armed with this information, you can decide on the top instructive pathway and financial prospects.

The government and educators understand that numbers are climbing, which means more money and resources must be available to achieve their college education goals. As you can picture, this has been an issue for some time. While ideal answers do not exist, we are beginning to see a change that makes it likely for more individuals to attend school. We have become part of that change through new offerings.

When looking at the average cost of earning a degree, potential earnings need to be a part of the equation. The truth is that there is a payoff for money spent, but again, understanding the cost of different degrees is essential. And even several areas of interest could help me choose a career. The following shows the amount of money a typical individual earns for various college degrees throughout a lifetime.

➢ Ph.D. earns: $3.9 million

➢ Professional degree earns: $3.6 million

➢ Master's Degree earns: $3.4 million

➢ Bachelor's Degree earns: $2.5 million

➢ School Diploma earns: $1.4 million

While the average cost of earning a four-year degree is on the rise, the difference in pay from someone with a high school diploma versus a bachelor's degree is at a minimum of $1.4 million between the two over a lifetime.

The importance of a college education. In high school, students may question the importance of a college education. They might ask, "Why is it influential to go to college?" The answer is that more than ever, attending college provides more opportunities for graduates than a lower education, which is less widespread to those who received higher education. For many high school students, earning income is an appealing thought. The actual situation that exists after graduating from high school, you are not going to make much money or obtain a stellar career unless the military is your option. Even though their education is not only stressed, they also educate you. However, the military is not for everyone, and most don't volunteer. It will be a struggle for you in the years ahead by have no trade, no college background, and no experience, and your age will be a factor and setback.

The rising cost of tuition deters other students. In contrast, higher education is one of the most substantial expenses. Its college degree status has become evident regarding earnings potential, knowledge, and career status. We pave the way to help you there through our programs, making it easier for you to succeed.

Home About Contact Bachelor’s Payment Plan Master’s Professional Ph.D. FAQ's Education Tax Benefits Student Debt Removal Plans

Foreign Exchange Rate

All foreign currency exchanges will be based on the daily rate of the US Dollar.

Six graduate programs account for 61.8% of graduate student loan debt

(Resource: Trends in Student Aid from The College Board. National Postsecondary Student Aid Study)

Home About Contact PSALTER 46 Investment Services

Bachelor's Degree Payment Plans Professional Degree Student Debt Removal Debt Exclusion

PSALTER 46 Investment Services™

Bachelor's Degree Programs

An educated society advances and changes things for the good of its nation and rules over the government because knowledge—not government—is power.

DRB

New York

A Bachelor's Degree is a widely recognized degree that can open up many job opportunities and lead to a promising career with high earnings. It is a degree available in various fields and typically requires four years of full-time study, which involves completing 120-semester credits or roughly 40 college courses. A Bachelor's Degree is considered a traditional college degree, which includes general education or liberal arts courses, such as English, psychology, history, math, and specialized courses in significant areas of study. A Bachelor's Degree is an essential prerequisite for most professional careers and an analytical component for anyone looking for career advancement. It is also a critical requirement for entering a graduate field of study, such as law or medicine. Graduates who obtain a Bachelor's Degree can either move straight into a career decision or pursue an advanced degree, further enhancing their career prospects.

Many high school students consider bypassing college due to the cost and potential debt they may incur. However, specific programs can help students complete their Bachelor's Degree debt-free. By doing so, students can unlock the door to their potential and career advancements. A Bachelor's Degree is a necessary credential that can aid you in succeeding in a broader range of positions. It indicates to a prospective employer that you are dedicated, firm to achieve something, and knowledgeable in your field. According to the Bureau of Labor Statistics, individuals holding a Bachelor's Degree also tend to have higher pay and are less likely to be unemployed.

We offer an Education Investment Portfolio Handbook covering a wide range of education plans, from preschool to a Ph.D. This comprehensive guide provides debt-free education options for your child and includes the best private schools of your choice. The hardcover book is available for $69.98 and is a must-have for anyone looking to secure their child's educational future. Our portfolio offers more than just this website opportunity; it relieves the burden of financial obligations and provides attractive rewards and benefits from other institutions. You can take the first step towards financial independence and security by purchasing the book and exploring all the opportunities it offers. Click here to order.

It is widely understood that a bachelor's degree is necessary to secure employment opportunities and advance your career. A bachelor's degree is a sign of dedication, determination, and expertise in your field, which can make you a more attractive candidate to prospective employers. Moreover, a bachelor's degree is often a prerequisite for acceptance into graduate programs such as medical or law school. According to the Bureau of Labor Statistics, those who hold a bachelor's degree also tend to earn higher salaries and have lower rates of unemployment.

However, the rising cost of college education can concern many families. To prepare for this, it is essential to plan and invest carefully. Starting early is critical, giving you time to save the necessary funds. You should identify the cost of the specific school or type of school you want your child to attend and estimate the average costs of tuition, fees, books, room, board, and other expenses for a 4, 6, 7, or 8-year program. It is also essential to invest in your child's education. Plan well, start as early as possible, and invest to ensure your child has enough funds to meet their daily needs. Additionally, PSALTER 46 is here to get the education you want for your child and keep you debt-free.

We offer the "Bachelor's Degree Programs (BDP)," which supports your search for higher education. The only requirement for participation in this program is to make an IO payment of $21,641.79 and wait 36 months for account maturity. Afterward, the University of your choice will receive $44,531.25 each year for four years, for a total of $178,125.00 to complete a bachelor's degree. Your average monthly IPR is $4,346.75 if you invest early in high school. The funds will be released to you at the time of admission. A flat 7% fixed return interest rate on your IPR will be applied yearly after the second year from the account maturity. When you graduate and close your College Opportunity Account, any remaining funds will be rolled into another investment arrangement. Click here to invest.

If college payments exceed your annual compensation, we will adjust it from your ITR balance to accommodate the fees. However, you will be liable for any funds that exceed your ITR balance. Your student package comprises "Tuition fees, Textbooks, Room & Board, Dental Plan, Healthcare Coverage, and a Life Insurance Plan for any unforeseen events or circumstances" at no additional cost. We also have a High-Grade Point Average Program (HGPAP) designed to improve students' academic grades. By sponsoring students in this program, we hope they will meet the entrance criteria of excellent schools. The categories that academies view and analyze are high school grades, GPA scores, teacher evaluations, letters of recommendation, writing the application essay, and any school committee participation. These factors will affect your application process and the school you desire to attend.

Your GPA is regulated by the grading policies and lessons taken in high school. Many colleges set a 3.0 standard for first-year students and admission transfers. However, they can consider students with lower GPAs. You should take at least 15 college-preparatory courses, with at least 11 completed before the beginning of the senior year of high school. Meet the examination requirements by taking the ACT, writing, or the SAT Reasoning Test by senior year. Some colleges do not require SAT Subject Tests, but individual programs on some campuses recommend them, and you can use subject tests to satisfy college-listed requirements.

When choosing a school for your child, the more prestigious the institution, the higher the tuition fees. However, many schools offer a quality education without the high costs associated with Ivy League Universities. Choosing one of these schools can ease the financial burden of education. It's essential to be realistic about how much money you need to save for your child's education. Many parents need to pay more attention to the cost and end up with insufficient funds. If you can motivate yourself to invest in your child's future, you will be well ahead of most people. Our academic programs can be customized to fit the requirements of any institution. We are familiar with the admission requirements of the top schools worldwide and can help you achieve your goals.

For $899.99, we offer the "Prestigious University Elite Planner." This purchase package includes a student's Healthcare Coverage for six years, a Dental Healthcare Plan for four years, Life Insurance for six years, and two (2) round-trip airfare tickets home during the summer break. We also will put your child in the HGPAP for 24 months to help them get into an elite school. You have a wide range of IOs to select from to determine your ITR to match the admission fee to the university of your choice. Leftover funds will be rolled over into a retirement account of your choice. Click here to order.

An intelligent economic future is one where children have a bright financial future, which can be achieved through a college education. As the world grows more competitive and technologically sophisticated, most high-paying jobs require skills learned in college. Studies have confirmed that the earnings gap between college and high school graduates has widened over the last 15 years. In the past, most employers expected workers to have a high school diploma, but now, a college degree is necessary for a well-paying job and a family unit's security. Additionally, a college education benefits the country, leading to a healthier and more developed society. It's understandable to feel intimidated by the costs of college, but it varies widely from college to college. Depending on your choices, the price of a college education can be reasonable, especially if you consider it an investment in your child's future or your own. Planning today for tomorrow should be a top priority.

Are you considering sending your child to college? If so, you may be aware that while college education has never been more valuable, it comes with a hefty price tag. For instance, a four-year education at a state university in your home could range between $19,548.00 and $42,000.00. If you opt for a four-year college at an Ivy League school like Princeton, the cost will be much higher, with tuition costing $62,400.00, food costing $11,910.00, and miscellaneous expenses reaching up to $4,050.00. However, you don't need to worry about the high costs. Our programs can help you calculate how much you need to pay for your child's education so you can plan accordingly. Moreover, it's important to note that the cost of college is expected to increase, which means today's prices could seem like bargains 15 years from now. Parents of a baby born in 2004 should expect to pay $73,000.00 to $146,000.00 for their child's public education and an overwhelming $282,000.00 to $350,000.00 for four years at a top-ranked private University.

But don't let the high costs discourage you. You can start planning today by asking yourself some questions, such as whether your child is more likely to attend a public university in their state or an out-of-state public institution, whether they will want to enroll at a top-ranked private college such as an Ivy League University, Stanford, MIT, or its equivalent, and how much chance they will want to attend graduate school. Considering these factors, you can make an informed decision about your child's future. In conclusion, while the cost of college may seem daunting, a junior or community college is often the most realistic choice for many students. Let us help you plan for your child's future today so you can rest assured that you're making the right choice.

Understanding the average costs of a college education is crucial as the price of a four-year degree continues to rise. Currently, most highly regarded companies that offer high-paying jobs prefer job candidates with a degree, even if it is unrelated to the industry. A college degree tells a story of stability, determination, focus, and dedication to job responsibilities to prospective employers. Many employers believe that if a potential employee has completed their education despite the cost, they will likely give their best at work. However, not everyone can afford a college degree, and the average price is relatively high. This does not necessarily mean someone without a college degree is less qualified than someone with one.

There are several options available to those who want to pursue a degree without having to take on student loans. Student loans can be a burden due to the debt that has to be repaid for many years. We offer an alternative way of obtaining a degree without the obligation of debt. At PSALTER 46, the cost of an average college degree starts at just $21,641.79. This can help you make an informed decision regarding your educational goals and financial prospects. By choosing us, you are not losing out but rather gaining a valuable degree at a significantly lower cost than other institutions or the government.

The rising number of students pursuing college education has prompted the government and educators to allocate more resources and finances. However, this issue has persisted for some time, and no one-size-fits-all solution exists. Nevertheless, we are witnessing a positive change that will allow more people to attend college. As part of this change, we are introducing new offerings to the education sector. When considering the cost of earning a college degree, it is essential to consider the potential earnings that come with it. Although there is a payoff for the money spent, it is crucial to understand the cost associated with different degrees. Exploring various areas of interest can also help in choosing a career. The following chart displays the average lifetime earnings for individuals with varying college degrees.

1.) Ph.D. earns: $3.9 million

2.) Professional degree earns: $3.6 million

3.) Master's Degree earns: $3.4 million

4.) Bachelor's Degree earns: $2.5 million

5.) School Diploma earns: $1.4 million

Investing in a four-year degree may seem costly. However, the difference in pay between someone with a high school diploma and a bachelor's degree is a staggering minimum of $1.4 million over a lifetime. Take advantage of this opportunity for a better future. Many high school students may question the importance of a college education, but attending college provides more opportunities for graduates than a lower education. With a college degree, obtaining a promising career and making a decent living can be more accessible. While the military is an option, it's not for everyone, and having no trade, no college background, and no experience can be a significant setback in the years ahead. The rising cost of tuition can be a deterrent for some students, but higher education is a substantial investment. A college degree can significantly impact earnings potential, knowledge, and career status. We offer programs that help pave the way to success, making it easier for you to succeed. Don't let the cost of tuition hold you back from a bright future. Invest in yourself and your education today. We are here to get you the funds you need to attend any school that you qualify for of your choice.

The importance of a college education lies in the increased opportunities it offers. In today's economy, high school graduates require higher education to access the high-paying jobs that were once widely available. The United States has shifted from a manufacturing-based economy to a knowledge-based one, making college education essential. In addition, college education provides incentives such as exposure to top experts in various fields, encouraging students to think critically and explore new ideas. College education also provides students with the opportunity to make connections, which can be beneficial for their careers. Graduates have an edge over those without higher education in the job market. Obtaining knowledge from college is valuable from many different perspectives, and although tuition costs are high, financial aid options are available. To make obtaining a degree more accessible, we have developed a unique monthly payment plan for 24 months for those who lack funds for a bachelor's degree. Following the contract's maturity date, the payments and benefits for college admission are made. We also offer customized educational proposal plans tailored to meet individual requirements and match them with the finest schools worldwide. The IO must be complimented for the school of the student's choice.

We offer the "College Payment Planner" for $599.99. This package includes a monthly IOs and ITRs payment plan to choose from, along with student healthcare coverage for four years, a dental healthcare plan for three years, life insurance for four years, and textbooks. The requirement for account maturity is based upon your selection of your IO Blueprint of Disbursement. Enrolling in this package also provides one round-trip airfare ticket and $1,000.00 in cash during summer break. If there are any remaining funds in the account after all payments have been made, they will be rolled into a retirement account as per the Articles of Agreements written in the COA. Click here to order.

The global economy is becoming increasingly competitive, and America needs well-educated individuals to remain a leader. Employers in all industries, including lawyers, doctors, chemists, journalists, scientists, engineers, manufacturers, and the military, seek the best-educated people for their businesses. A college education can give you the best chance for a well-paying job and ultimately help you get ahead. It can also be essential if you plan to have a family someday and care for your children. Attending college provides students with knowledge, determination, perseverance, character-building, and experience. Higher education funding can pay off hugely because it can help you get there.

A college education offers many benefits. It can be a wonderful experience for many who enjoy college life, especially those away from home for the first time and taking on their primary responsibility. It is an achievement that can lead to a career. Students are exposed to new subjects, expanding their mindset and experiencing unprecedented changes in a new environment, evening after-school excitement, and meeting new friends worldwide. Universities offer subjects and fields of study not available in secondary schools. This exposure can help students figure out exactly what they want to do for a living. College teaches new outlooks and higher reasoning, setting the tone for your potential. Many people enjoy the freedom that college life brings. They are away from home but can pursue their dreams and interests and sharpen their experience in the way they want. A college education can also inspire students to stay in academia and pursue post-secondary research in their fields.

We offer the "Bachelor's Degree Programs (BDP)" that can help you with your higher education goals. To participate in this program, you must make an IO payment of $46,283.58 and wait 36 months for account maturity. After that, you can use $89,062.50 each year for four years at a university of your choice. If there are any funds left unused during the year, they will be rolled over. You will receive an ITR of $356,250.00 to complete your bachelor's degree. If you invest in the program early in high school, you can receive an average monthly IPR account of $8,610.00 for the following three years, and the funds will be released to you at the time of admission. The program offers a flat 7% fixed return interest rate on your IPR, which will be applied yearly after the second year from the account maturity. When you graduate and close your account, the remaining funds will be rolled into another investment arrangement of your choice. In case of death, the primary beneficiary will receive your COA as an heir. If you are interested in investing. Click here to invest.

Private institutions. Private institutions in the United States are integral to the overall higher education system. From the hallowed corridors of Harvard to the groundbreaking education made available to women at Wesleyan College, private colleges serve to educate and prepare students to become productive members of society. While public colleges and universities also serve a similar purpose, there are distinct benefits to attending a private institution.

The focus of most private colleges is the student rather than research and publishing, as is common at public institutions. This student focus allows private colleges to favor professor-led lectures and labs rather than a teacher's assistant-led class. Students benefit from a highly educated professor's new knowledge and expertise rather than a graduate student. Professor-driven classes also help reduce discrepancies between the information presented in a style and the information covered in exams. Private institutions keep small class sizes as a reminder that students come first. By having lower classes and individual attention, students can ask questions and reflect on their thoughts more easily. Smaller categories have more interactive classroom experiences.Private institutions. Private institutions in the United States are integral to the overall higher education system. From the hallowed corridors of Harvard to the groundbreaking education made available to women at Wesleyan College, private colleges serve to educate and prepare students to become productive members of society. While public colleges and universities also serve a similar purpose, there are distinct benefits to attending a private institution.

Students are more known at large universities by their identification numbers than their names. Knowing your professors and other students at smaller private colleges is easier. There are more opportunities for recognition and awards for exceptional students than at public institutions. Religious denominations many private colleges have. Private schools can present students seeking a college with close ties to their religious faith as a place to study with others of the same faith. For some students, scholarships are available based on their ethical relationship.

Are you planning on playing college sports? The college you aspire to, the education you need, and the dreams that you have had are all part of your future. Apart from your academic curriculum at the institution, sports are. To be noticed playing sports in college can be fun and gratifying. However, you are not likely to receive grants except if you are already making headlines. America is a multicultural nation; it is vital that everyone, no matter what race or ethnicity you belong to, has an equal right to a good education. Getting into college, especially a good one, requires some early planning. It would help if you understood what it takes to get into a top-notch school. You also need to know what is necessary to play for a Division I or II school since you need more than athletic skills. Suppose you plan to play sports at I or II Division levels as a first-year student. It would be best to familiarize yourself with NCAA eligibility prerequisites as early as your sophomore year of high school because you need to meet them to make the team. Every athlete must meet minimum standardized test scores and core curriculum requirements, whereby you must continue to meet academic needs each year. If you satisfy the NCAA's and the school's educational program conditions, excelling at a sport will only keep you on a college team.

NCAA academic requirements vary depending on the division level of the school. Still, you can be sure that you will need to maintain a GPA of 2.00. The NCAA publishes an annual guide on the ins and outs of eligibility and distinctions among recruiting rules at I, II, and III Division schools. Look for the handbook at www.ncaa.org. Broadly established, an important goal in education is a post-secondary degree. The United States labor market strengthens that belief with substantial financial rewards. Due to a sizable percentage of minority students living in disadvantaged areas, the public education system is responsible for educating students about all instructive endeavors post-graduation. Make sure that your child receives college preparatory awareness and teaching. They are your kids, so get them to think of their children someday by being well-educated. We have excellent programs for many; it is up to you which is best for your needs.

Are you a student who loves sports but worries that it might affect your academic performance? Look no further. Studies have shown that playing sports has a positive impact on your physical and mental health and your academic performance. From official NCAA-level sports to club and intramural leagues, there are many opportunities for you to engage in physical activity and team sports while also excelling academically.

Exercise of any kind can increase blood flow to the brain, leading to increased concentration, enhanced memory, better creativity, and problem-solving skills. These skills are essential not only in sports but also in the classroom. Moreover, playing sports provides opportunities to develop crucial interpersonal skills such as leadership, time management, and teamwork. These skills can be transferred to your future career and academic endeavors, resulting in positive outcomes. Being part of a team and community can also enhance your self-esteem, efficacy, and self-worth. Furthermore, bonding with teammates through team-building activities, practice, competitions, and traveling can translate into academic support and motivation. Colleges and universities offer special tutoring and study sessions with student support services to help, motivate, and improve your academic performance.

In addition to these benefits, student-athletes may be eligible for athletic-based scholarships, need-based, and merit-based financial aid that can alleviate the stress of paying for college. By joining a sports team, you achieve a healthier physical and social lifestyle and improve your academic performance and future career prospects. Don't let your worries about sports impede your academic success. Join a team and reap the benefits. With sports, you can strike a balance between your academic and athletic goals. So go ahead, lace up those shoes, and hit the field or court!

Prestige Universities. Private colleges are some of the most historic and prestigious higher education facilities in the United States. Attending one of these colleges lends name recognition to your degree, which is helpful when looking for your first job. Alum organizations at private colleges are typically active and find student assistance, including beneficial internships.Traditional bonds. Strong traditions of private colleges are known for their rites, passed down to students over generations. These traditions create a sense of community through strong relationships among students and between students and alums. These bonds can provide lifelong friendships as well as opportunities.

Environment. Private institutions create a more favorable environment for learning. They will likely focus more on nightly parties, significant athletic events, and demanding sorority and fraternity life. With fewer diversions, students can focus on their studies, retain more information, and have a better chance for successful graduation. A private college benefits students who wish to continue their education since admission to graduate programs is often highly competitive.

Facts about Minorities. Although the number of minorities in college has increased substantially in recent years. The percentage changes are minor, and significant gaps remain among the main US ethnic groups. Throughout the years, studies have shown that although more minorities have enrolled in institutions of higher education, only a tiny percentage graduate. Black Americans made up 14.0% of the population in the United States. The statistics show that more Black students in institutions of higher learning in 2015 than 84.0 % of blacks received a high school diploma in 2015, and 65.0% enrolled in college. Out of that percentage, 24.0 % did not graduate. 14.0% drop out of high school. 2.0% for other reasons. Although statistics show enormous progress in registering black students throughout college, many factors prohibit minority students from graduating.

4.70% of Asian Americans make up the United States population as of 2015, and 84% of Asian American students finish high school. 44.7% of Asian Americans earned a college degree. They lead the nation among minority groups regarding higher education. Latin Americans make up 16.1% of the United States population. The US Census Bureau considers Hispanic to mean persons of Spanish/Hispanic/Latino origin, including Mexican, Cuban, Puerto Rican, Dominican Republic, Spanish, and Central or South American descent living in the US, which may be of any race or ethnic group (White, Black, and Asian. Studies illustrate that many Latinos are enrolled in college. Yet, they pursue other roads that only sometimes lead to a college degree. 12.2% of Latinos graduate college from an enrollment number of 24.1%, the lowest in the nation.

We offer the "Private Learning Planner" for $599.99, which can help you find your child's private middle school or high school. With our selection of IOs that you can choose from, your ITR should complement the institutions of your choice. PSALTER 46 can cover all the private school admissions fees of your choice. This planner can put your child in middle school through high school and even college or vocational school without any financial burden or debt. If your child lives at the school, room and board are all-inclusive. This purchase includes the student's healthcare coverage, dental plan, a Life Insurance Policy for four years, and yearly textbooks. It is mentioned in the Articles of Agreements written in the COA. If any finances were to be left over from the account, the funds would be rolled over into a retirement account following graduation from the school, setting your child up for retirement. Click here to order.

Are you pursuing a Master's or Ph.D.? A Master's degree can lead to a more excellent range of career opportunities, such as advancement, higher salaries, benefits, and company prestige. More professionals are returning to school to receive a Master's degree and pursuing the correct quality positions. The degree allows students to gain expertise in a new field of study or deepen their knowledge in the same area. The doctorate is the highest degree attainable in most academic disciplines. Earning a doctorate requires the student to master the experience in his field of interest and contribute to it through original research. Earning a doctorate is rigorous and time-consuming but personally and professionally satisfying. A holder of this degree is respected, esteemed, and has authority in their profession. A Ph.D. achieved is an exclusive reward in institutional learning.

Choosing the right college can be a daunting task. But don't let a school's reputation be the only deciding factor. Instead, focus on who you want to become and whether the campus offers the latest hands-on technologies to support your education. Remember, quality education is all about critical thinking and verification, not personal ideologies. When making decisions, listen to your heart and your logical reasoning. It's better to take action than to remain indecisive. Every day, we make decisions that shape our lives. Making the right decision can be challenging, but you can approach it from multiple perspectives and choose the most reasonable and balanced option. If you're considering attending college, take the time to research your options. Don't let the decision overwhelm you. By focusing on who you want to become and what you want to achieve, you'll be better equipped to make the right choice. Remember, your decision will impact your future, so choose wisely.

Visit the college campus. If you are on the fence about a specific school, attend accepted student events or pre-orientation programs they host. They often offer more than just a campus tour. They allow you to meet your prospective classmates, talk with professors, and get your academic questions answered. Be sure to stop by the residence halls, check out the dining facilities, and visit other student hangouts, especially if you have not seen them during any previous trip to the school. Trust your gut; how did you feel when you first stepped foot on the grounds? Sometimes, just wandering around campus one more time can put your mind at ease about your final decision.

Make a list of advantages and disadvantages. It is one of the oldest tricks in the book for a reason. Creating a list of each potential college's pros and cons can help you decide. Ask your parents, guidance counselors, and other mentors for their thoughts. An outside perspective can help you think of something to drive your decision. Discussing your options with your family can be substantial. Only consider the opinions of those you trust. After all the reflecting, talking, and assessment, question yourself by asking:

1.) What sort of class setting suits your learning atmosphere, small or large?

2.) Does the college's robustness match your own?

3.) Do you require a close campus community or an expansive, natural environment?

4.) Sports, traditions, group activities, events, and hobbies that are there for you to enjoy.

The following list of schools and costs may help you decide which college or university to attend. It's essential to know the requirements and standards of each discipline. Reviewing the websites can help you determine what kind of school would suit you through us, as every institution has something to offer—learn, grow, and get started on your career path. Imagine yourself on these campuses, walking through their hallways and playing sports. Imagine developing relationships with new people and taking part in group activities.

Deciding between college or trade school can take time and effort. However, both options offer the opportunity to obtain essential skills and knowledge that can lead to a fulfilling and lucrative career. If you're still on the fence, here are some factors to consider: First and foremost, follow your passion. Select a career path that you're passionate about, and that aligns with your interests. If you enjoy aerospace, for instance, consider a career in electronic and electrical engineering, where you can help improve electrical and electronic systems for aircraft and unmanned vehicles.

Additionally, consider your hobbies. They can align with real-world needs and job opportunities, so take the time to explore how they can lead to a career path you'll love. When selecting a career path, remember to consider where you want to be in the future and set realistic goals to help you get there. Think about what type of degree is best suited for your desired career and the costs associated with obtaining it. While academic knowledge is essential, developing cross-cutting experiences such as teamwork, critical thinking, and information technology skills is equally crucial. These skills are vital for success in today's ever-changing job market. Finally, remember that behavioral skills and collaboration play a significant role in predicting future success. Teachers and mentors can help you identify your strengths and weaknesses and guide you in the right direction. By considering all these factors carefully, you can set yourself on a path toward a fulfilling and prosperous career.

It is important to understand financial management tools, especially since the Internet has become a popular source for economic and investment services. Though the Internet can bring monetary comforts right to your doorstep, it is just a tool that should be used cautiously. To invest wisely, excellent decision-making skills and an understanding of the potential risks are essential, mainly when investing online.

If you have signed a Contract of Agreement (COA) for an education plan program, it is essential to remember that you have the right to cancel it within 72 hours of receiving your payment invoice. If you fail to cancel in that time frame, you will be bound to the terms and conditions in the Articles of Agreements of the contract.

Studies have shown that college graduates tend to be healthier than non-college students. They are less likely to smoke and have a better understanding of nutrition, leading to healthier eating habits. Additionally, college students are more aware of health issues and exercise more often. However, entering a graduate program is a significant decision that should not be taken lightly. Considering the pros and cons of pursuing higher education and how it may affect your future well-being and your family is essential. It would be best to consider whether you have the discipline and stamina to handle the emotional and stress levels that come with graduate studies.

It is vital to ensure that employers, authorities, and other institutions will recognize your chosen degree or certificate. Most colleges and universities in America are accredited by professional governing bodies, ensuring a quality education and recognized credentials. However, it is still crucial to thoroughly research each school's accreditation before deciding. There are thousands of schools in America that offer credentials that are recognized worldwide.

College Campus experience. The friends gained during college are worth as much as the education. Many make friends that last lifelong. The curricula learned, activities ventured and lived with others worldwide are invaluable experiences that will have memories.Worldwide attention. Students can no longer focus on particular geographic areas when obtaining academic training. Often, colleges and universities concentrate on the international aspects of each subject, better-preparing students with a global view of their field. Most US learning institutions have recognized this and offer a more wide-ranging universal curriculum to meet new trends.

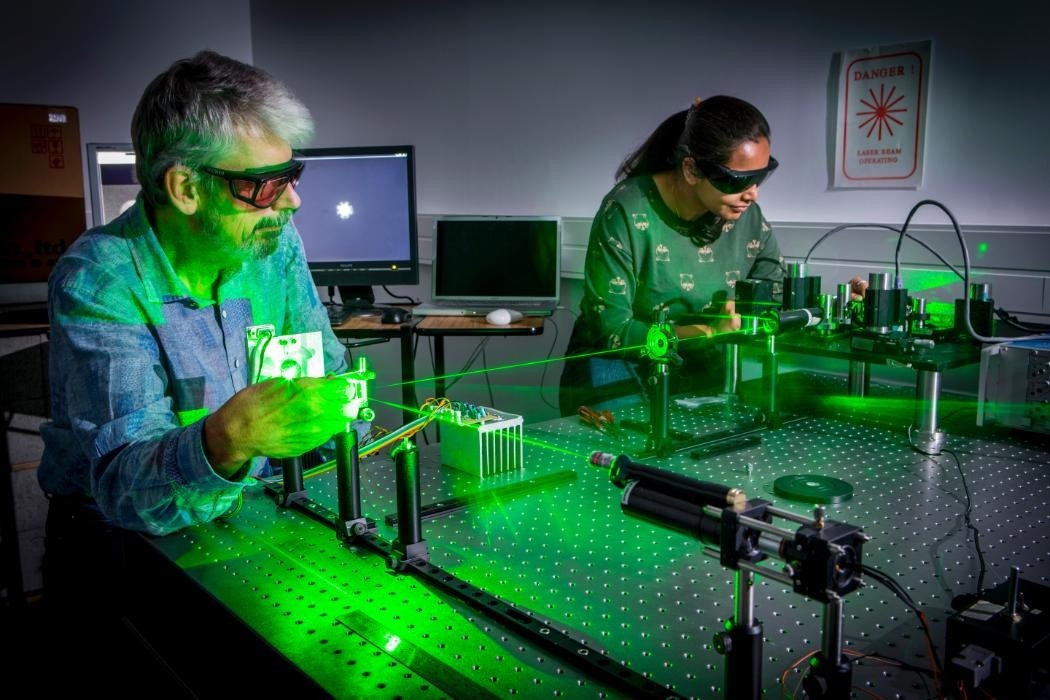

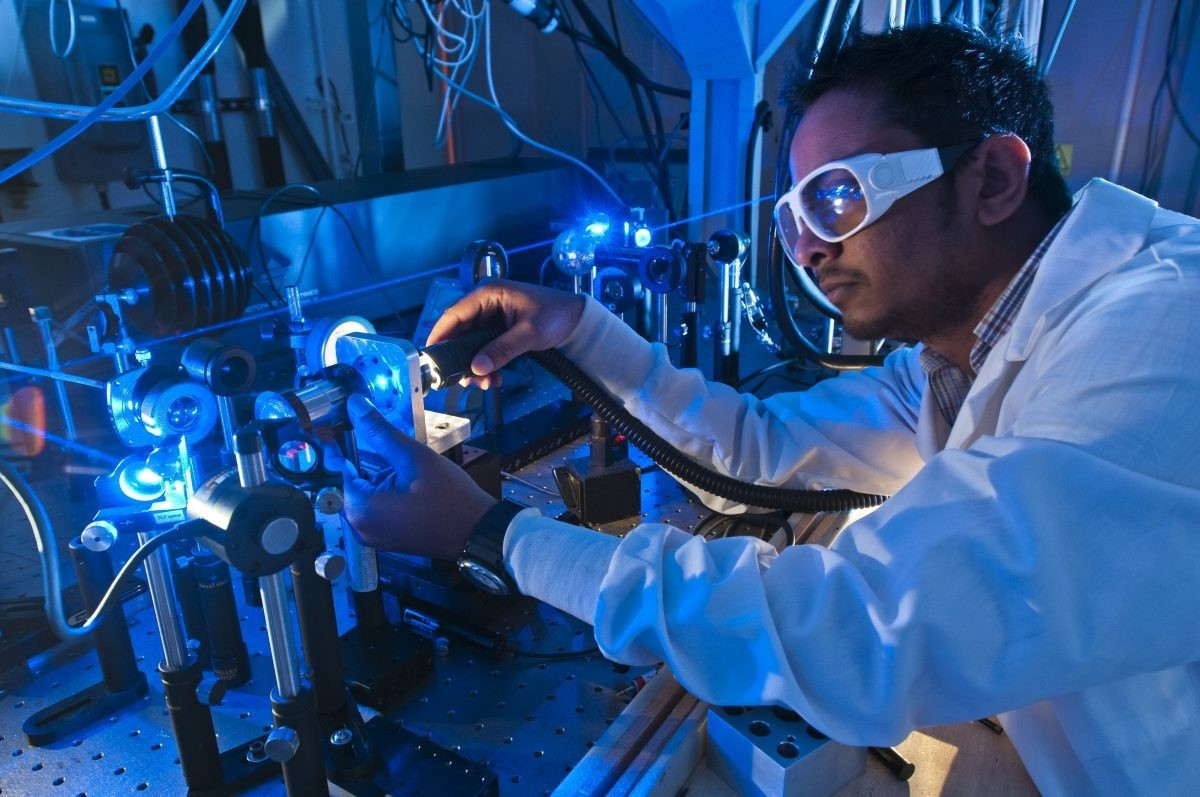

They are working with new technology. Irrespective of what degree a student chooses to pursue in school, they must use computers and other technologies to succeed. Many universities incorporate the latest technology into their curriculum, encouraging students to obtain proficiency before entering the workplace. Focused technology, such as the newest medical equipment, emerging technologies include educational technology, information technology, nanotechnology, biotechnology, cognitive science, psycho-technology, robotics, medical equipment, and artificial intelligence. It allows each student to maximize their true potential and gain marketable experience in the real world.

Knowledge. After all, a Ph.D. also means you have much knowledge and information about your field. You are authoritative and knowledgeable in your area of study. Your experience is theoretical and of practical use, and you can share it with others for problem-solving. Friends, colleagues, government officials, the military, corporations, and the media will highly value your educated opinion. You become influenceable to those around you.

Account Contingency Plan Resource Insurance (ACPRI). We ensure your education account through ACPRI during your COA. It is to assure that your payments will be payable on time to the college or university as stipulated in the contract. Many business owners feel business insurance is an expense they cannot afford or is a luxury for more established companies. However, business insurance can indeed be expensive. It is an expense every professional, regardless of the industry, size, or length of time, needs to include in its budget as we do for you. We know that no one likes to have interruptions or burdens. That is why we have taken all available precautions for any possible event. As you know, no one wants to hear an excuse regarding their account.

Catastrophic loss. ACPRI insurance protects us from closing due to a devastating loss. Fires, floods, hurricanes, typhoons, diseases, financial, and tornadoes have ended many businesses. When a company carries insurance against these types of losses, as we do, closure and loss are only temporary instead of permanent. Each account's risk assessment is modest, as we sell food products. Throughout the animals' rearing cycle, veterinarians maintain good health care and farm organic vegetables and fruits. Pesticides designed to prevent damage to plants and crops from insects can reduce excellent health standards if not administered and processed correctly. We avoid them. We meet market demand as our products are preset and sold to our outlets beforehand. We pass the required percentage from the BDF for your education plan onto your account.

Make an Appointment Today. Please make an appointment today to find out how we can assist your child in attending college at a low cost to receive a degree. We also customize and match an IO to the college or university of your choice. We can meet with you anywhere in our US offices or worldwide. Click here for an appointment.

We are pleased to offer you the "Elite High-End College Program (EHCP.)" Our program is designed to help your child gain admission to a private college or university of your choice. With EHCP, you can select any private institution in the United States, Canada, or the United Kingdom. By enrolling your child in EHCP today, you can help secure a bright future for them with the best early education possible. The only requirement to participate in this program is an investment of $70,000.00 with a 38-month waiting period before account maturity. After this period, your child can attend the college or university of their choice. As part of this program, you will receive the following benefits: an annual admission fee of $86,700.00 for four years, which includes textbooks, medical healthcare, dental care, room and board, and life insurance. All of this is available for an investment IO of $71,000.00, and you will receive a return ITR of $346,000.00. Click here to invest.

PSALTER 46 turns things around to meet your dreams. Start you on a career path that bears no financial burdens and has a debt-free education with benefits. We help you meet the requirements to get into a college or university of your choice. Talking with an Educational Consultant is the best thing you can do. You'll feel relieved knowing there are other options and benefits for getting a good education without borrowing money. Americans are more troubled by student debt loans in 2018 than ever before. The average student debt for the Class of 2017 was $40,450.00, an increase of 6.1% from the previous year. Debt facts on Student Loans. The most recent student debt report indicates the following statistics:

a.) The total US student loan debt is $5.2 trillion.

b.) Direct loans to student borrowers in loan debt of 28 million.

c.) Student loans that are 90 days or more delinquent or are in default 12.5%.

d.) Average student monthly loan payments of $400.00.

e.) Median monthly student loan payment of $250.00.

f.) FFEL loans $290.3 billion to 14 million debtors.

g.) Perkins loans $7.1 billion to 3 million borrowers.

Total: 45 million student borrowers nationwide.

How students' debt mounts up based on their school type.

h.) Seniors graduating from public and nonprofit colleges in 2018 had student loan debt of 67%.

i.) Graduating from public and nonprofit colleges, the average debt was $29,300.00 in 2018, increasing by 1% from the previous year.

j.) Graduates from public colleges had loans of an average of $29,400.00.

k.) Graduates from private nonprofit colleges had loan debt on average of $32,300.00 at 75%.

l.) Graduates from profit colleges had loans on debt, an average of $39,950.00 at 88%.

m.) Privately held was student debt by the previous graduating class of 2018.

n.) 49.29% of borrowers who attended for-profit colleges default within ten years. It is compared to 13.1% of public college attendees. In addition to

14% of nonprofit college attendees.

o.) Graduates who received Pell Grants were likely to borrow. Pell Grants had an average debt balance of $32,000.00 from 89% of their graduates.

54% of those who didn't receive a Pell Grant had student loan debt.

Understand the tools of financial debt management. Working knowledge of essential personal debt management, excellent decision-making skills, and understanding of the potential risks from one debt to another, particularly in cyberspace. The Internet has become a round-the-clock source of control. Financial services, debt services, investment services, brokers, and advisers bring monetary comforts to you without leaving your home. Trading electronically and online investing have become famous worldwide as more people explore the Internet for new personal gain. It is vital to remember that it is just a tool. You can cancel your contract within 72 hours after receiving your digital Invoice online or signing your instrument. After 72 hours, you are bound to the contract's terms and Conditions of the Articles of Agreements (AOA.)

Countries that the United States of America Treasury Department sanctions. No exceptions will be made to this. As a responsible and ethical Company, I will not do business with prospective investors or representatives of investors in Iran, Syria, Russia, or North Korea, per the United States of America Treasury Department Sanctions Program.

You will receive a payment invoice. Along with the Contract of Agreement (COA) and Articles of Agreements (AOA), all legal documents about the Primary Beneficiary, Secondary Beneficiary, Certificate of Investment in Education, Projected Financial Statement, The Authorized Incapacitated Consent Form, The Account Blueprint of Disbursement Form will immediately be sent via FedEx/UPS or DHL to your home address following confirmation.

Making decisions requires weighing up the costs and benefits. Considering both sides of the equation is essential to avoid the negative consequences of poor choices. This means assessing whether you have the necessary resources to complete a task before committing to it. Not doing so can lead to adverse outcomes such as abandonment of a project, economic loss, and even damage to one's reputation. In short, it's crucial to evaluate the cost of a decision before taking action. PSALTER 46 is here to help you avoid poor choices and ensure a financially sound future and lifestyle. We can assist with your educational needs and keep them debt-free. Unlike other institutions where you must apply for a loan and pay interest for years, PSALTER 46 offers benefits, advantages, and debt-free programs for your educational needs.

PSALTER 46 cares about your decision-making conditions. Decision-making involves ascertaining the condition under which a decision is made. The way the decision-maker tackles a problem depends on one of the following three conditions under which a decision is made. The ideal situation for making decisions is one of certainty, where a person can make accurate decisions because the outcome of every alternative is known. However, most decisions are not made with certainty. Decision-making under risk is more common than those made under certainty. The Internet has become an indispensable hub for business management, providing numerous financial services such as investment options, brokerage services, and advisory services right at your doorstep. As a result, online trading and investment are gaining immense popularity among investors who want to increase their wealth. However, it's essential to note that the Internet is a tool. Excellent decision-making skills and an understanding of the potential risks are crucial when investing, primarily online.

We are pleased to offer three exceptional Portfolio Handbooks that are unlike typical investment reading material. These hardcover books provide comprehensive plans that can change your life or circumstances. These books offer investment opportunities not available on our website but only through these portfolio books. Each book is priced at $69.98, and is a must-have for anyone interested in financial independence and security. Moreover, they provide more attractive rewards and benefits than other institutions.The portfolio handbooks offered contain exclusive investment promotional offers that are sure to amaze you. One of these offers is unique in that upon investing in it. You will receive a complimentary automobile with the car title registered in your name debt-free with a rewarding ITR. This offer is only available through PSALTER 46 and cannot be found anywhere else. order: 1.Click on the link provided. 2. Don't wait any longer. 3.Take the first step towards financial freedom today.